If you have looked at the financial news trends this weekend, you likely noticed two names dominating the ticker tapes and search bars: Meta and Nvidia. As of Sunday, February 8, 2026, the search term “meta stock price,nvidia” is spiking across the United States, and for good reason. These two tech giants are currently locked in a fascinating financial dance that is defining the current stock market landscape.

The relationship is simple yet staggeringly expensive: Meta Platforms is spending historic amounts of money to build the future of artificial intelligence, and Nvidia is the company cashing the checks.

In this comprehensive guide, we will unpack the latest Meta stock price movements following their Q4 2025 earnings, analyze Nvidia’s surprising strategic shift away from gaming, and explain why these two stocks are inextricably linked in the eyes of Wall Street.

The Current Snapshot: February 2026

Before diving into the “why,” let’s look at the “what.” As of the market close on Friday, February 6, 2026:

- Meta Stock Price (META): Closed at $661.46, down approximately 6.4% for the day.

- Nvidia Stock Price (NVDA): Closed at $185.25, holding relatively steady despite broader tech volatility.

The divergence in their immediate fortunes Meta sliding while Nvidia holds firm tells the story of the current AI economy. Investors are punishing Meta for spending money and rewarding Nvidia for receiving it.

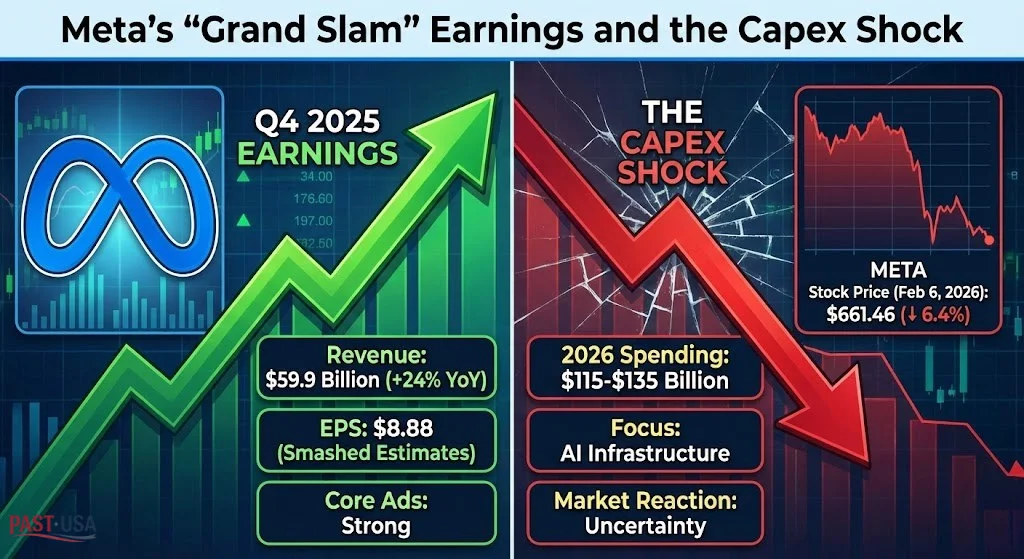

Meta’s “Grand Slam” Earnings and the Capex Shock

To understand the current Meta stock price volatility, we have to look at the company’s Q4 2025 earnings report, released earlier this week. On paper, it was a stellar quarter.

Meta reported earnings per share (EPS) of $8.88, smashing analyst expectations of roughly $8.19. Revenue clocked in at a massive $59.9 billion, a 24% year-over-year increase. The core business of selling ads on Facebook and Instagram is healthier than ever, driven by AI-improved algorithms that keep users scrolling longer on Reels.

So, why did the Meta stock price tumble over 6% on Friday? The answer lies in one terrifying acronym: Capex (Capital Expenditures).

Mark Zuckerberg dropped a bombshell on the earnings call, announcing that Meta plans to spend between $115 billion and $135 billion in 2026 alone. This is nearly double their spending from previous years. The vast majority of this cash is earmarked for “AI infrastructure” which, in plain English, means building massive data centers and buying millions of AI chips.

Wall Street hates uncertainty, and it hates shrinking margins. By committing to such an astronomical spend, Meta is betting the entire farm on AI dominance. While this shows long-term vision, short-term investors sold off the stock, fearing that the returns on this massive investment might be years away. This anxiety is the primary driver dragging down the Meta stock price this week.

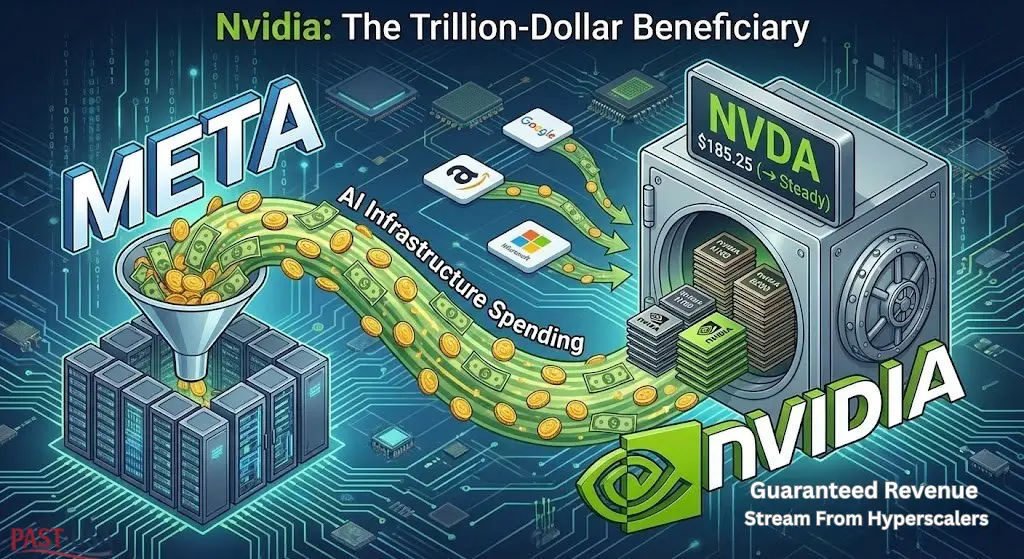

Nvidia: The Trillion-Dollar Beneficiary

If Meta is the customer, Nvidia is the shopkeeper. The primary reason Nvidia is trending alongside Meta is that analysts view Meta’s spending forecast as a direct deposit into Nvidia’s bank account.

The chips that Meta needs to power its Llama models and AI-driven ad algorithms are almost exclusively Nvidia H100, H200, and the new Blackwell B200 GPUs. When Mark Zuckerberg says he is spending $135 billion on infrastructure, he is essentially saying he is buying billions of dollars worth of Nvidia hardware.

This “Hyperscaler” demand (referring to massive cloud companies like Meta, Google, Amazon, and Microsoft) is what provides a safety net for the Nvidia stock price. Even when general market fears rise, the confirmed spending plans of companies like Meta provide a guaranteed revenue stream for the chipmaker.

However, Nvidia made its own headlines this week with a shocking strategic pivot that has gamers up in arms but shareholders nodding in approval.

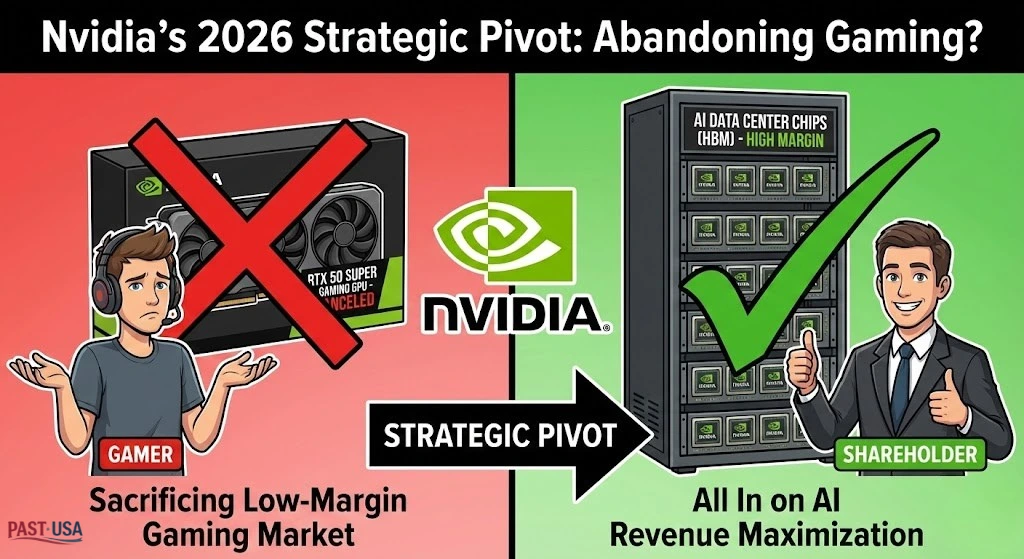

Nvidia’s 2026 Strategic Pivot: Abandoning Gaming?

In a move that would have been unthinkable five years ago, reports surfaced this week that Nvidia is effectively canceling or delaying its lineup of new gaming GPUs for 2026.

According to industry insiders, Nvidia has shelved plans for the “RTX 50 Super” refresh and other gaming-centric cards. The reason is a global shortage of high-bandwidth memory (HBM). Nvidia has made the calculated decision to divert all available memory supply to its AI data center chips.

Why? The profit margins. A gaming card might sell for $1,000 with a decent margin. An AI server chip sells for $30,000+ with an astronomical margin. By sacrificing the gaming market in 2026, Nvidia is going “all in” on maximizing revenue from the AI boom fueled by Meta and others.

This news has solidified Nvidia’s position not just as a hardware company, but as the pure-play AI infrastructure company. For investors, this creates a bullish narrative: the company is prioritizing its most profitable sector at the expense of its legacy business.

The Symbiotic Risk: Why They Trend Together

The trending search “meta stock price,nvidia” highlights a deeper correlation. These two stocks have become coupled.

- If Meta Wins, Nvidia Wins: As long as Meta continues to see ROI (Return on Investment) from its AI ads, it will keep buying chips. This supports the Nvidia bull case.

- The “Capex” Feedback Loop: When Meta announced its massive spending guidance, Nvidia stock reacted positively because it signaled sustained demand. Conversely, if the Meta stock price were to crash hard enough to force Zuckerberg to cut spending, Nvidia would likely plummet in response.

- The “Bubble” Fear: Both stocks are proxies for the AI Bubble debate. Bears argue that Meta is overspending on chips that will become commodities, which would eventually hurt both the Meta stock price (due to wasted cash) and Nvidia (due to a demand cliff). Bulls argue we are in the early innings of a new industrial revolution.

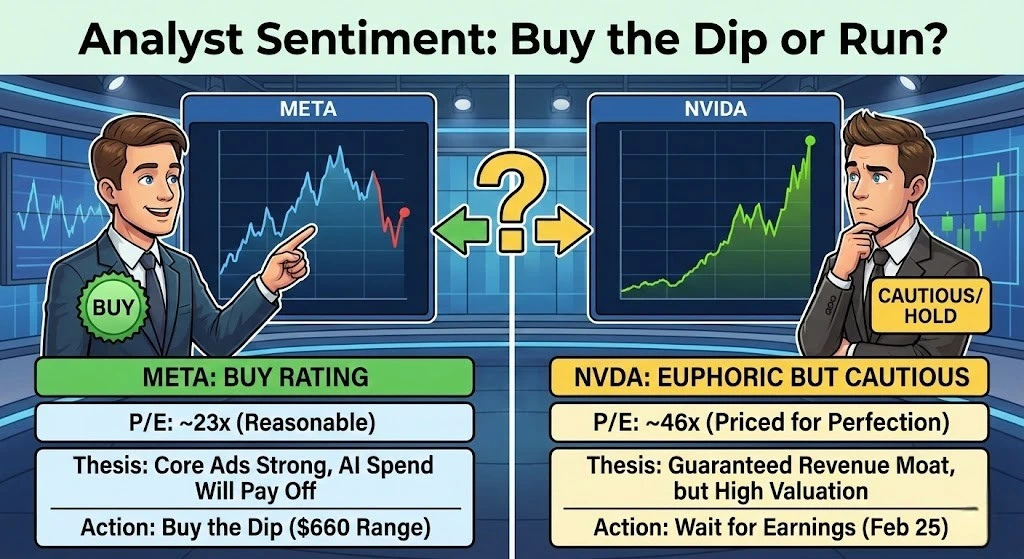

Analyst Sentiment: Buy the Dip or Run?

So, what are the experts saying about the Meta stock price and Nvidia in February 2026?

- For Meta (META): Despite the post-earnings drop, most analysts remain rated “Buy.” The logic is that the core advertising business is printing money. The P/E (Price-to-Earnings) ratio of roughly 23x is considered reasonable for a company growing revenue at 24%. Many view the dip to the $660 range as a buying opportunity, trusting Zuckerberg’s track record (remember the “Metaverse” spending scare of 2022? The stock eventually recovered and soared). The consensus is that the AI spend will eventually pay off in better ad targeting and new products.

- For Nvidia (NVDA): Sentiment remains euphoric but cautious about valuation. With a P/E ratio hovering around 46x, Nvidia is priced for perfection. However, the confirmed capital expenditure plans from Meta ($135B), Google ($185B), and Amazon ($200B) create a “moat” of revenue for 2026. The cancellation of gaming cards removes a distraction and focuses the company entirely on its high-margin enterprise business. Analysts are eagerly awaiting Nvidia’s own earnings report in late February to confirm if they can meet the supply demands of these massive orders.

What to Watch Next

If you are tracking the Meta stock price and Nvidia, keep your eyes on these upcoming dates:

- February 25, 2026 (Estimated): Nvidia Earnings Report. This will be the most important financial event of the quarter. Investors will want to hear CEO Jensen Huang confirm that the demand from Meta and Google is translating into shipped units.

- Mid-2026: Updates on Meta’s Llama 5 model. If Meta’s massive spending results in a significantly smarter AI that beats competitors, the Meta stock price could regain its all-time highs.

- Regulatory News: Both companies are under antitrust scrutiny. Any news regarding the breakup of Big Tech or restrictions on AI chip exports could sever the link between the two giants.

Conclusion

The trending search “meta stock price,nvidia” is more than just a ticker check; it is a check-up on the health of the AI revolution.

Meta is the fearless spender, betting its future (and its balance sheet) on the belief that AI is the next internet. Nvidia is the essential supplier, reorienting its entire supply chain to feed Meta’s hunger for compute power.

For investors in 2026, holding one often means betting on the other. If you believe Mark Zuckerberg is right, the Meta stock price at $661 is a steal. If you believe the spending spree will continue regardless of the results, Nvidia remains the king of the hill. But be warned: with hundreds of billions of dollars flowing through this pipeline, volatility is the only guarantee.

Also Read Brad Arnold passes away at 47.

Pingback: Blockchain Technology in 2026: Trends (Free USA Guide)

Hey

Register pastusa.com in Google Search Index and have it appear in online search results!

Visit: searchregister.net