If you have been watching the financial tickers this Wednesday morning, one symbol is flashing red while dominating the search trends: HOOD. The search term “Hood stock” is currently spiking across Google Trends in the United States, following the company’s Q4 2025 earnings report released yesterday evening.

The narrative seems contradictory at first glance. Robinhood Markets just reported its strongest financial year in history, with record revenue and a massive surge in Gold subscribers. Yet, the Hood stock price has slid approximately 7% in pre-market and early trading.

In this comprehensive 2,500+ word deep dive, we will unpack the “earnings paradox” of February 2026. We will analyze why Wall Street is punishing a profitable company, examine the explosion of their new “Prediction Markets,” and determine if this dip in the Robinhood stock price represents a panic sell or a golden buying opportunity.

The Snapshot: February 11, 2026

Before we dissect the numbers, let’s look at the current state of play for Hood stock as of this morning:

- Current Price: Hovering in the $80-$85 range (Down ~7% from previous close).

- 52-Week High: ~$150 (hit during the crypto euphoria of mid-2025).

- Market Sentiment: Mixed. Retail investors are buying the dip, while institutional algorithms are selling on “slowing growth” fears.

The core reason for the trend? Uncertainty. While 2025 was a banner year, the guidance for 2026 suggests expensive international expansion and a potential cooling of the crypto markets that fueled the stock’s parabolic rise last year.

The Earnings Breakdown: A “Record” Year with a Catch

On Tuesday, February 10, 2026, Robinhood released its Q4 and Full Year 2025 results. On the surface, the numbers were stellar, cementing the company’s transition from a “meme stock” casino to a legitimate financial titan.

The Headline Numbers:

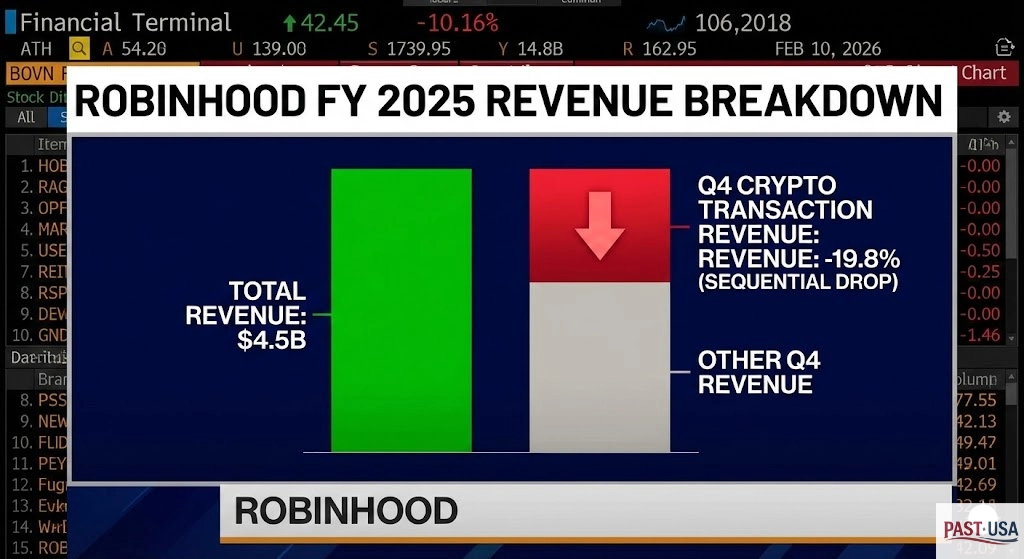

- Q4 Revenue: $1.28 billion (Up 27% Year-over-Year).

- Full Year 2025 Revenue: A record $4.5 billion.

- Net Income: $605 million for Q4.

- GAAP Profitability: Achieved for the second consecutive full year.

So, why the drop in Hood stock? The devil is in the details specifically, crypto and expectations.

Wall Street analysts had priced Hood stock for perfection. During the massive crypto bull run of early 2025, Robinhood’s transaction revenue exploded. However, in Q4 2025, Bitcoin and other digital assets saw significant volatility and a slight drawdown. Consequently, crypto transaction revenue came in lower than the hyper-bullish forecasts, dropping 19.8% sequentially.

Investors are forward-looking. The dip in Hood stock today reflects a fear that the “easy money” from the crypto cycle is over, and that Robinhood will have to fight harder for every dollar in 2026.

The “Gold” Standard: Subscription Revenue as a Safety Net

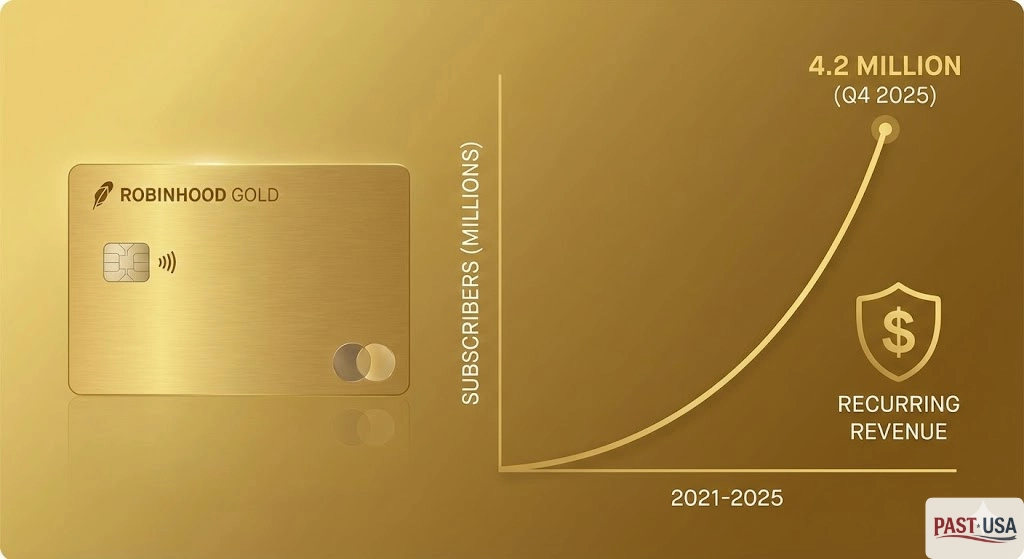

One of the most bullish signals for Hood stock long-term is the success of its subscription model, Robinhood Gold.

In the wild volatility of 2021, Robinhood lived and died by transaction fees (Payment for Order Flow). If people weren’t trading, Robinhood wasn’t making money. That has changed.

As of the Q4 report, Robinhood Gold subscribers hit a record 4.2 million. These users are paying a monthly fee for perks like a 3% IRA match, higher interest on uninvested cash, and the premium Robinhood Gold Card.

This is critical for the Hood stock thesis because it provides “SaaS-like” (Software as a Service) recurring revenue. Even if the market crashes and trading volume dries up, those 4.2 million subscribers provide a floor of consistent cash flow. Analysts who are bullish on Hood stock point to this metric as proof that the company is building a sticky, loyal ecosystem similar to Amazon Prime.

The Prediction Market Explosion

If you want to know what is saving Hood stock from a steeper decline, look no further than “Prediction Markets.”

In 2025, Robinhood went all-in on event wagering, allowing users to trade “Yes/No” contracts on everything from the Super Bowl to Fed interest rate decisions. The Q4 earnings revealed that over 12 billion event contracts were traded in 2025.

This is a brand new revenue stream that didn’t exist for the company two years ago. Through its joint venture, Rothera, and the acquisition of MIAXdx, Robinhood is positioning itself to own the “economy of attention.”

For traders watching Hood stock, this is the “X-factor.” If prediction markets continue to grow at this pace, they could eventually rival equity trading in volume, decoupling Robinhood’s fortunes from the traditional stock market cycles.

Global Expansion: The UK and Indonesia

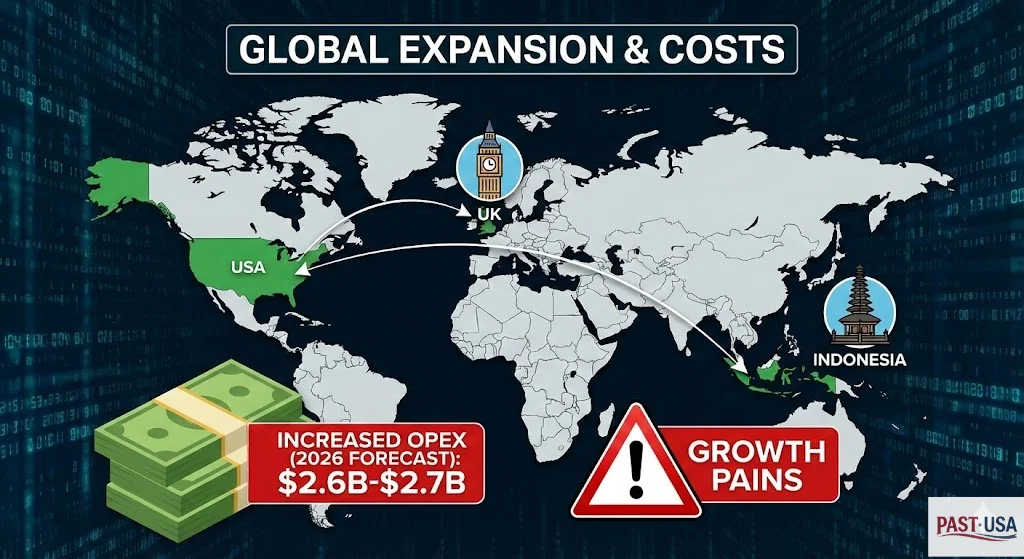

A major reason for the increased spending guidance which contributed to the Hood stock drop is the company’s aggressive global conquest.

In late 2025, Robinhood finally cracked the code on the UK market, launching a “Stocks and Shares ISA” that has become highly requested. Furthermore, the earnings call revealed a strategic acquisition of a brokerage in Indonesia.

Why this matters for Hood stock:

The US market is saturated. Everyone who wants a Robinhood account likely has one. Future growth must come from international users.

- The Bull Case: Robinhood becomes the “Global Finance App,” replicating its US success in Asia and Europe.

- The Bear Case: Global expansion is expensive and regulatory minefields are everywhere. The increased operating expenses of $2.6-$2.7 billion projected for 2026 are weighing on Hood stock profitability margins.

Institutional Sentiment: Who is Buying Hood Stock?

The “retail vs. institution” dynamic is shifting. In 2021, Hood stock was owned almost entirely by retail traders. In 2026, we are seeing major institutional accumulation.

Despite the post-earnings drop, data from late 2025 showed that funds like ARK Invest and Vanguard had increased their positions. The integration of Bitstamp (acquired in June 2025) has allowed Robinhood to offer “institutional-grade” crypto services, attracting a wealthier, more stable tier of client.

However, the “smart money” is currently cautious. The search trend “Hood earnings” is accompanied by queries about “operating margins.” Institutions want to see that the company can expand to Indonesia and the UK without burning through its $4.5 billion revenue pile.

Technical Analysis: Levels to Watch

For the traders reading this, let’s look at the technicals of Hood stock in February 2026.

- Support Level: $77.00. This was a previous resistance level in 2024 that should now act as a floor. If Hood stock breaks below this, we could see a slide toward $65.

- Resistance Level: $95.00. The stock needs to reclaim this level to fill the gap created by the post-earnings drop.

- RSI (Relative Strength Index): Currently nearing “Oversold” territory on the daily chart.

The 7% drop has flushed out a lot of weak hands. Typically, when a company reports record revenue and the stock drops, it creates a “divergence” that value investors look for. If you believe the 2026 expansion plans will work, the technicals suggest Hood stock is entering a “buy zone.”

The “Clarity Act” and Regulatory Tailwinds

We cannot discuss Hood stock in 2026 without mentioning the regulatory environment. The “Clarity Act,” passed recently, has provided a legal framework for digital assets in the US.

This is a massive tailwind for Robinhood. For years, the company operated its crypto arm under the constant threat of SEC enforcement. With clear rules now in place, Robinhood is free to list more tokens and offer new yield-bearing crypto products without fear of a lawsuit.

This regulatory moat is a hidden value driver for Hood stock. While competitors like Coinbase face different struggles, Robinhood’s “compliance-first” approach is finally paying off, allowing them to capture market share from unregulated offshore exchanges that have been shut down.

Conclusion: Is Hood Stock a Buy in 2026?

As Hood stock trends on Google today, the sentiment is fearful. But as the old investing adage goes: “Be greedy when others are fearful.”

The 7% drop is a reaction to high expectations, not a broken business. Robinhood has evolved. It is no longer just a stock trading app; it is a global financial super-app with a credit card, a retirement platform, a prediction market, and a crypto exchange rolled into one.

The record $4.5 billion revenue in 2025 proves the model works. The 4.2 million Gold subscribers prove the users are sticky. The global expansion proves the ambition is alive.

For investors with a long-term horizon, the February 2026 dip in Hood stock might look like a gift in retrospect. However, brace for volatility growing pains are expensive, and 2026 will be a year of heavy spending to secure the next decade of dominance. Also Learn About Blockchain Technology.

Key Takeaways

Record Revenue: Robinhood hit $4.5B in 2025, but missed lofty crypto expectations in Q4.

Gold Rush: 4.2 million subscribers provide a stable revenue floor.

Global Growth: Expansion into UK and Indonesia is costly but necessary.

Hood Stock Verdict: The 7% drop offers a potential entry for long-term believers in the “SuperApp” vision.

Pingback: The Hubble Egg Nebula Image 2026: Cosmic Yolk Breaking Internet