In the fast-evolving landscape of digital innovation, blockchain technology has finally graduated from its rebellious teenage years of volatile crypto speculation into a mature, sophisticated era of enterprise infrastructure. If you are searching Google for “blockchain technology” right now, you are likely noticing a shift in the narrative. It is no longer just about Bitcoin prices or bored ape JPEGs; it is about the fundamental “plumbing” of the global economy.

As we settle into 2026, the United States is witnessing a watershed moment for decentralized networks. With major legislative frameworks like the GENIUS Act and the Clarity Act making headlines, and institutional giants like BlackRock and Visa fully integrating on-chain settlements, the question is no longer if blockchain will be adopted, but how fast it will reshape our daily lives. This article dives deep into the trending developments, the multi-billion dollar hacks that shaped the security landscape, and the real-world applications driving the next industrial revolution.

From Hype to Hybrid: The 2026 Blockchain Landscape

For years, critics dismissed blockchain technology as a solution looking for a problem. However, 2026 has silenced many of those skeptics. The prevailing trend this year is “invisibility.” Much like you don’t think about the TCP/IP protocols that power your email, the average user is beginning to interact with blockchain-powered systems without even realizing it.

The adoption curve has shifted vertically. We are seeing a move away from monolithic, “do-it-all” blockchains toward modular architectures. These specialized networks decouple execution, settlement, and data availability, allowing for unparalleled scalability. This shift is crucial because it allows blockchain technology to handle the transaction throughput required by global credit card networks and stock exchanges a feat that was impossible just a few years ago.

Furthermore, the integration of Artificial Intelligence (AI) with blockchain has become a foundational stack for modern tech. While AI generates content and data at superhuman speeds, blockchain provides the “proof of truth,” offering immutable provenance to distinguish between human-made and AI-generated content. This symbiosis is proving critical in a year where digital identity verification is a top national security priority.

The Legislative Unlock: The Clarity and GENIUS Acts

One of the primary reasons blockchain technology is trending in the USA right now is the massive shift in regulatory posture. For a decade, regulatory uncertainty chilled innovation, driving talent offshore. That changed with the introduction and subsequent debates around the Clarity Act and the GENIUS Act.

These legislative frameworks have provided the “rules of the road” that institutional investors were desperate for.

- The Clarity Act aims to finally settle the “security vs. commodity” debate, giving clear jurisdiction to agencies like the CFTC for certain digital assets.

- The GENIUS Act (Guidance for Emerging Networks and Innovative US Strategies) focuses on fostering domestic innovation, establishing “sandboxes” where startups can experiment with blockchain technology without fear of immediate enforcement actions.

This newfound legal ground has emboldened banks to launch stablecoin settlements and allowed major asset managers to tokenize treasury bills, effectively merging traditional finance (TradFi) with decentralized finance (DeFi).

Trend 1: The Tokenization of Real-World Assets (RWA)

If there is one buzzword defining blockchain technology in 2026, it is “Tokenization.” We are witnessing the financialization of everything. Real-World Assets (RWAs) tangible assets like real estate, gold, fine art, and government bonds are being moved on-chain.

Why does this matter? Liquidity. Traditionally, selling a commercial building or a piece of fine art takes months and involves expensive middlemen. By representing these assets as digital tokens on a blockchain, they can be fractionally owned and traded 24/7.

BlackRock’s aggressive push into this sector has been a major catalyst. Their ability to offer tokenized money market funds that settle instantly has forced other Wall Street giants to catch up. In 2026, it is not uncommon for a diversified portfolio to include not just stocks and bonds, but fractional ownership of a Manhattan skyscraper or a rare vintage car collection, all secured and traded via blockchain technology.

Trend 2: Supply Chain Transparency and Authenticity

The supply chain crisis of the early 2020s taught the world a painful lesson about opacity. In response, industries ranging from automotive to luxury fashion have turned to blockchain technology to create unbreakable chains of custody.

The Luxury Sector

The Aura Blockchain Consortium, utilized by brands like Louis Vuitton and Prada, has set the standard. In 2026, when you buy a high-end handbag, it comes with a “digital twin”an NFT that proves its authenticity and ownership history. This has dealt a massive blow to the counterfeit market. If a product doesn’t have a verifiable entry on the blockchain, it is essentially worthless in the resale market.

Automotive and Manufacturing

Companies like BMW and Tesla are leveraging blockchain technology to track the provenance of raw materials. With strict new US regulations regarding battery material sourcing and ESG (Environmental, Social, and Governance) compliance, manufacturers must prove their cobalt and lithium were mined ethically. Blockchain provides a tamper-proof ledger of every step in the material’s journey, from the mine in the Congo to the factory floor in Texas.

Trend 3: The Security Reckoning

It would be dishonest to discuss the state of blockchain technology without addressing the elephant in the room: security. Late 2025 and early 2026 saw some of the most devastating hacks in history, serving as a brutal wake-up call for the industry.

The Bybit hack, which resulted in a staggering loss of approximately $1.5 billion, shook the crypto world to its core. Unlike previous exploits that targeted code vulnerabilities, this attack compromised “multisig” (multi-signature) wallets through sophisticated social engineering and access control failures. It proved that even the most secure smart contracts are vulnerable if the humans managing them are compromised.

Similarly, the Nobitex hack ($90 million+) highlighted the geopolitical risks, with state-sponsored actors targeting exchanges. These events have driven a massive pivot toward Zero-Knowledge Proofs (ZKPs) and non-custodial solutions. The industry is rapidly adopting “compliance-by-design” security architectures, where blockchain technology is used not just to transact, but to mathematically prove the security of the system without revealing sensitive user data.

Sector Spotlight: Healthcare Revolution

The US healthcare system, notorious for its fragmented data silos and administrative bloat, is finally embracing blockchain technology to center care around the patient.

Platforms like BurstIQ and Akiri are leading the charge. In 2026, the focus is on Patient-Centric Identity. Instead of having your medical records scattered across five different hospitals and specialist clinics, blockchain enables a “Self-Sovereign Identity” (SSI). You, the patient, hold the “keys” to your medical history. You grant a doctor temporary access to your records via a secure token, and once the visit is over, you can revoke that access.

This solves two massive problems:

- Interoperability: Doctors get a complete view of your health history, preventing dangerous drug interactions.

- Privacy: Your data isn’t sitting in a vulnerable centralized database waiting to be hacked.

Furthermore, pharmaceutical supply chains are using blockchain technology to meet the requirements of the Drug Supply Chain Security Act (DSCSA), tracking prescription drugs to prevent counterfeits from entering the pharmacy system.

Sector Spotlight: Voting and Governance

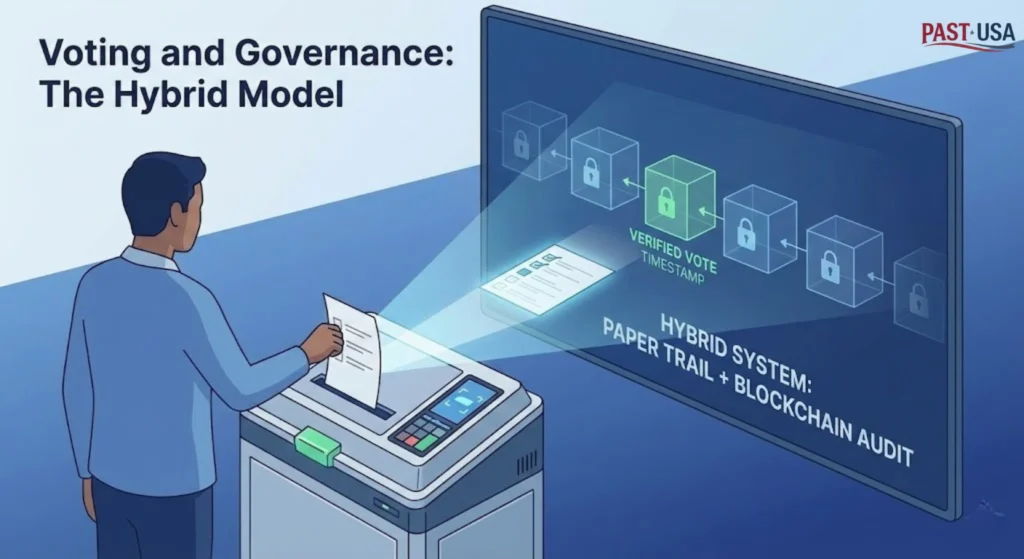

Perhaps the most contentious yet promising application of blockchain technology remains in voting systems. With election integrity being a perpetual hot-button issue in US politics, 2026 has seen renewed interest in blockchain-based pilots.

Legislative proposals like the “Make Elections Great Again Act” (H.R. 7300) have sparked debate about modernizing election infrastructure. While nationwide blockchain voting is not yet a reality, states like West Virginia (which pioneered mobile voting with Voatz years ago) and others are eyeing expanded pilots for overseas military personnel.

The premise is simple: blockchain technology can theoretically offer a voting record that is impossible to alter (immutable) and universally verifiable (transparent). However, computer security experts remain cautious, arguing that while the ledger might be secure, the devices (smartphones/PCs) used to cast votes are still vulnerable to malware. The 2026 consensus is moving toward “hybrid” systems paper ballots for the primary record, with blockchain used for backend auditing and tally verification to detect any discrepancies instantly.

Challenges and The Path Forward

Despite the bullish trends, blockchain technology faces significant hurdles in 2026.

Energy Consumption

While the industry has largely pivoted away from energy-intensive “Proof of Work” (like Bitcoin) to greener “Proof of Stake” mechanisms (like Ethereum), the environmental narrative persists. New “Regenerative Finance” (ReFi) protocols are attempting to turn this weakness into a strength by using blockchain to verify carbon credits and incentivize green energy production.

Scalability vs. Decentralization

The “Blockchain Trilemma”the difficulty of achieving security, scalability, and decentralization simultaneously is being tackled by Layer 2 solutions and modular blockchains. However, these add layers of complexity. For blockchain technology to reach billions of users, this complexity must be abstracted away. Users shouldn’t need to know they are on “Optimism” or “Arbitrum”; they just need the transaction to work instantly and cheaply.

The Talent Gap

With the GENIUS Act spurring innovation, there is a shortage of qualified blockchain developers in the US. Universities and coding bootcamps are scrambling to update curriculums, but demand far outstrips supply, driving up costs for startups and enterprises alike.

Conclusion: The “Internet of Value” Has Arrived

As we look at the trajectory of blockchain technology in 2026, it is clear that we have moved past the “Wild West” phase. We are now in the “Industrial Age” of digital assets.

The convergence of regulatory clarity, institutional capital, and technological maturity has created a perfect storm for adoption. Whether it is verifying the authenticity of a luxury watch, enabling instant cross-border payments, or securing patient data, blockchain technology is becoming the silent engine of the modern economy.

For investors, developers, and businesses, the message is clear: The technology is no longer coming; it is here. The winners of the next decade will be those who understand how to leverage this trustless, transparent infrastructure to build value in the real world.

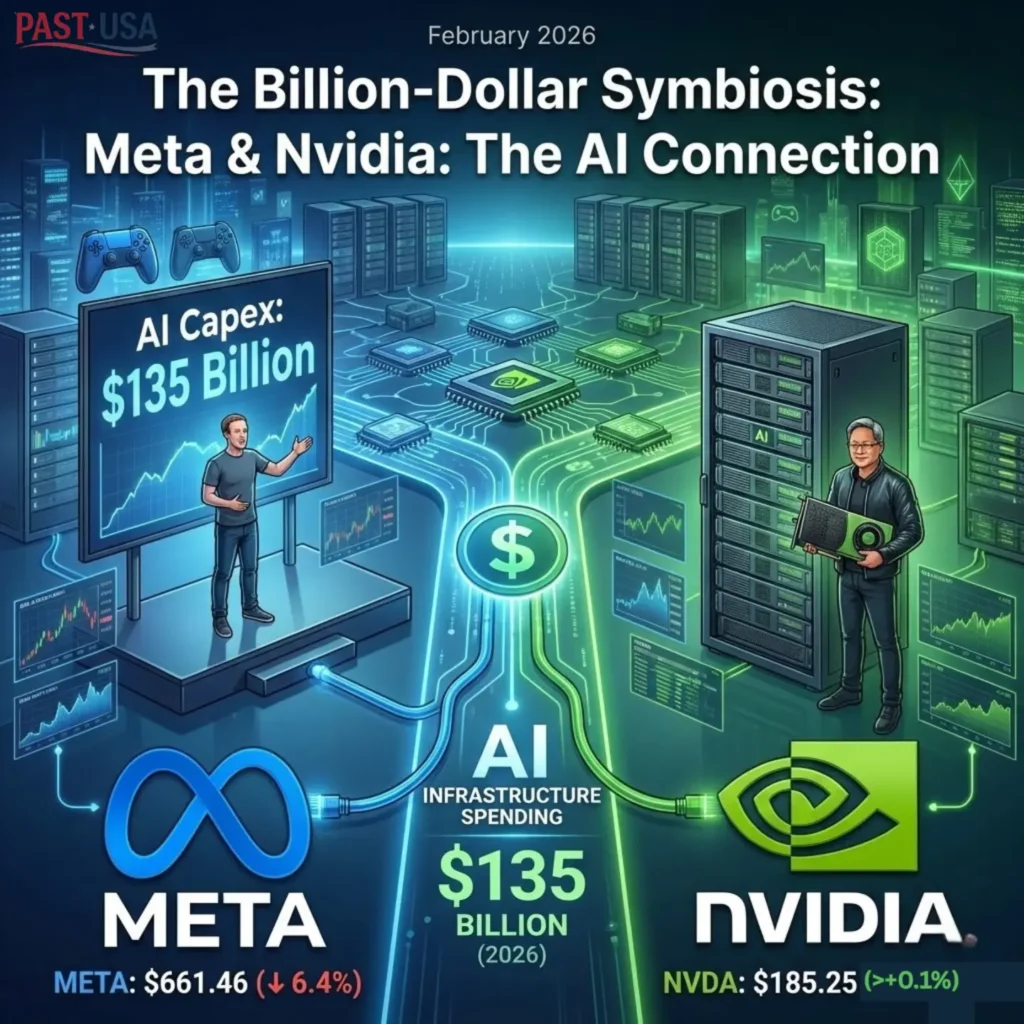

Read About Meta Stick and Nvidia.

Pingback: Hood Stock in 2026: Why Record Earnings Triggered a Sell-Off